Emmanuel GOBET - Images

-

Valuation of an American Put (optimal stopping problem),

using an optimization of the exercice boundary.

Based on the boundary sensitivity formula from Boundary

sensitivities for diffusion processes in time

dependent domains (C. Costantini, E. Gobet and N. El

Karoui), Applied

Mathematics

and Optimization, Vol.54(2), pp.159-187, 2006.

|

Green: the optimal

boundary.

Red: the iterative

approximation.

Axis: x for time, y for space.

(Reload to get the boundary animation). |

|

Convergence of the value function (put price) through

iterations. |

-

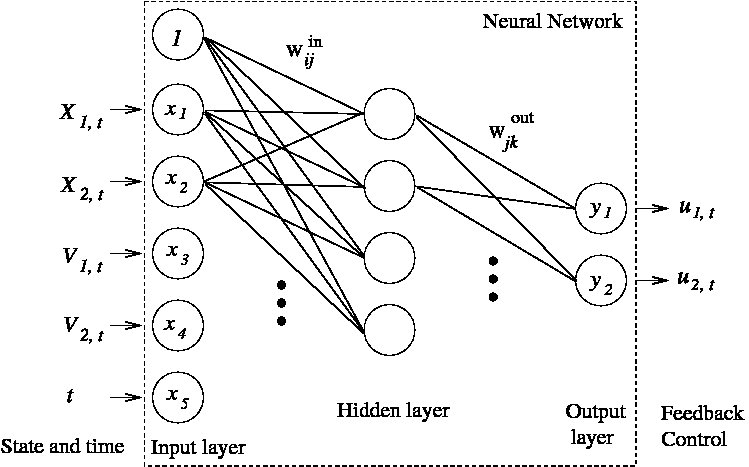

Convergence of policy value iteration in 4-d dimensional

stochastic control problem.

Example from Sensitivity analysis using Itô-Malliavin calculus

and martingales. Application to stochastic optimal control

(E. Gobet and R. Munos),

SIAM Journal on Control and Optimization, Vol.43(5),

pp.1676-1713, 2005.

|

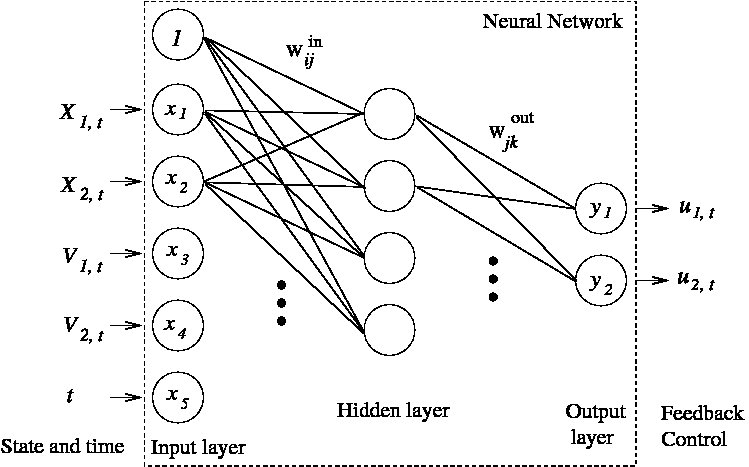

The neural network to approximate the policy as a

function of time and space. |

|

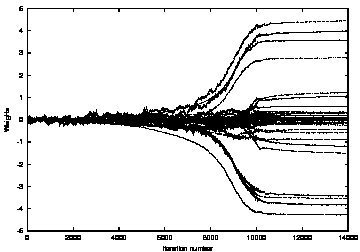

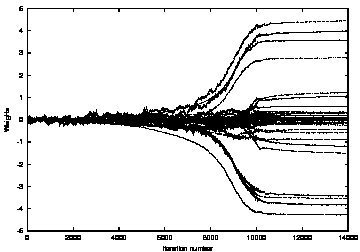

The evolution of the neural network parameters through

the stochastic optimization algorithm. |

|

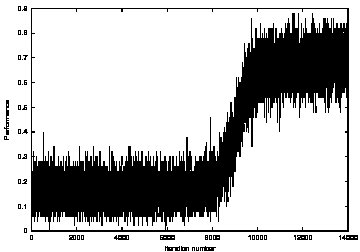

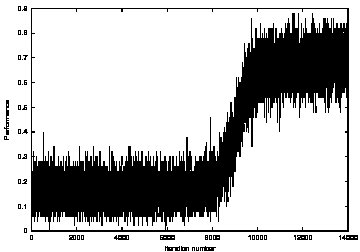

Performance of the algorithm (maximization of a

probability of reaching a stochastic fly). |

-

Geometric convergence of the adaptive control variates

algotithm.

Based on

|

2-d

example, convergence of the error to 0, using only 2 (!!)

simulations

at each point of the grid. The solution is polynomial and

polynomial

interpolation is used to approximate the solutions. Each

image

corresponds to a new iteration (Reload to get the

animation). |

|

Comparison of the geometric convergence using 2 or 100

simulations. |

|

Performance of the algorithm when the solution is not

polynomial and

polynomial interpolation is used (Reload to get the

animation). |

|

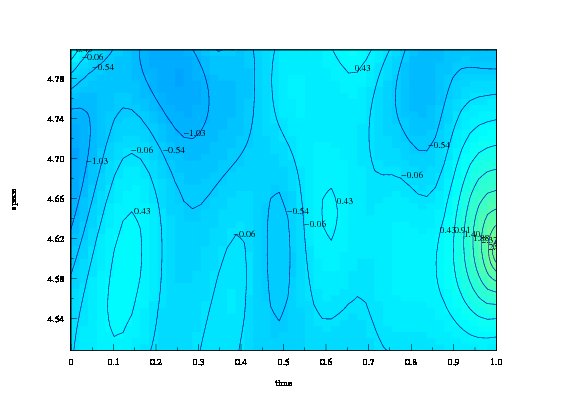

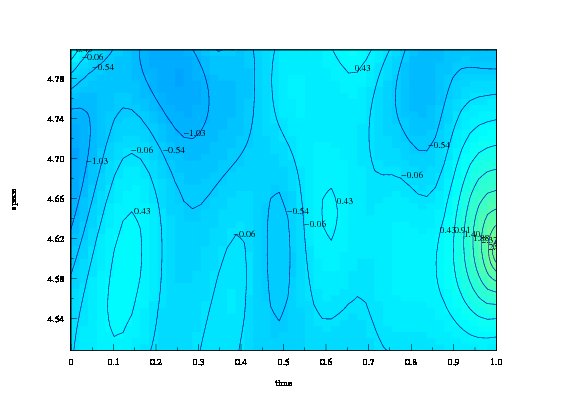

The same type of algorithm is now designed and tested on

Backward

Stochastic Differential Equations (associated to

semi-linear PDE). Here

is the convergence for call payoff and linear driver.

Axis: x for space and y for time. The errors are larger

close to the singularity (2,1) (i.e. the strike). |

-

Boundary shifting to compensate overestimation of exit times.

Based on

- Stopped diffusion processes: overshoots and boundary

correction (E. Gobet and S. Menozzi), Stochastic

Processes and their Applications, Vol.120, pp.130-162,

2010.

- Advanced Monte Carlo methods for barrier and related

exotic options

(E. Gobet), Handbook of Numerical Analysis, Vol. XV. Elsevier.

Special

Volume: Mathematical Modeling and Numerical Methods in

Finance. Editor:

P.G. Ciarlet. Guest Editors: Alain Bensoussan and Qiang Zhang.

pp.497-528, 2009.

|

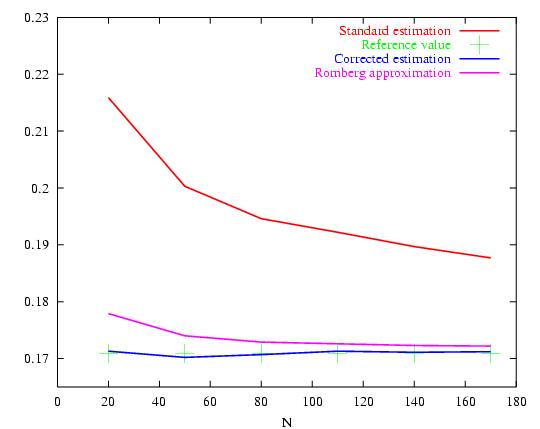

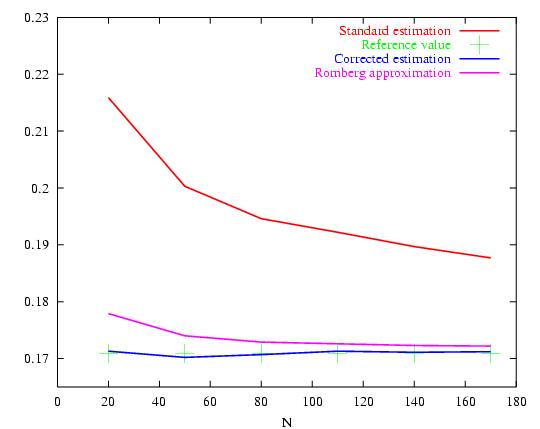

Convergence

comparison between the standard method (discrete exit time

in Red),

Romberg extrapolation (pink) and the boundary correction

method (blue).

The advantage of the Boundary correction method over

Brownian bridge

techniques is its avalaibility in any dimension. |

COPYRIGHT 2009, 2010.

CMAP UMR 7641 Ecole Polytechnique and CNRS, Institut Polytechnique de Paris, Route de Saclay, 91128 Palaiseau Cedex France